(Versions in Español and Português)

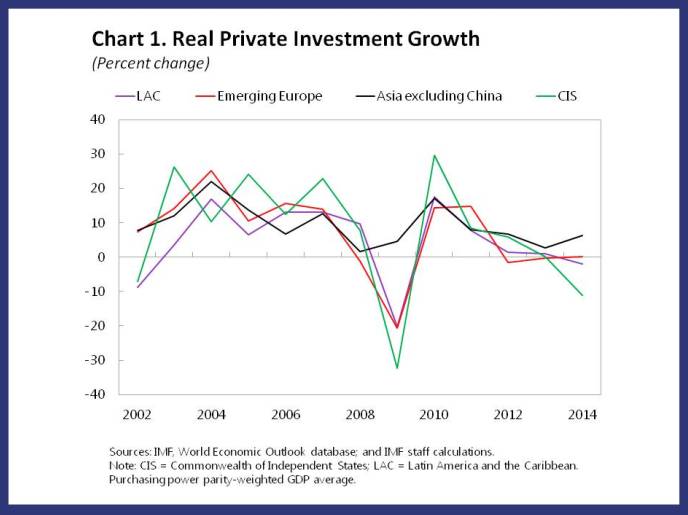

Private investment has been decelerating throughout emerging markets since mid-2011, and Latin America has been no exception (see Chart 1). This trend has raised concerns not only because weaker investment has played an important role in the broader regional slowdown, but also because Latin America’s investment rates were lower than in most other regions even before the slowdown began.

This blog looks at the drivers of corporate investment and highlights the extent to which falling commodity export prices have contributed to lower capital spending. Given the poor outlook for commodity prices and what our analysis suggests, this does not bode well for countries in the region going forward unless they can tackle some of the long-standing obstacles to increase investment.

Latin America’s low investment problem

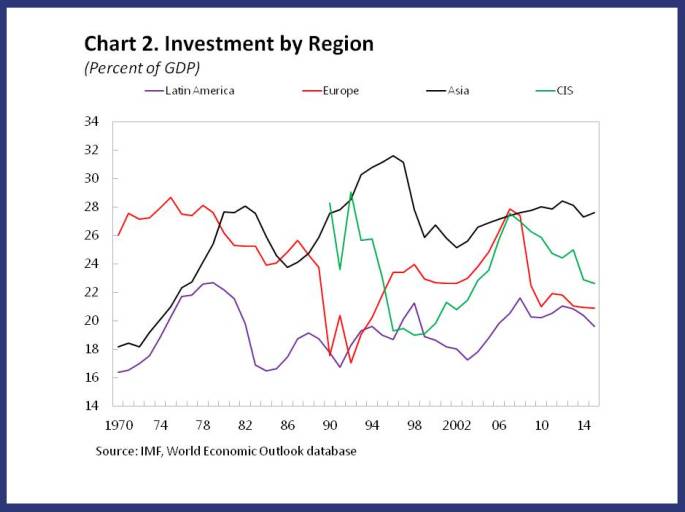

From the perspective of Latin America’s economic history, the recent investment slowdown does not appear particularly alarming. As shown in our latest Regional Economic Outlook, the average ratio of investment to GDP has fallen about two percentage points from its 2008 peak, but at 19.6 percent remains slightly above the historical average (see Chart 2). However, the share of investment to GDP has persisted significantly below the comparable values from other emerging market regions, which arguably represents an important constraint on potential growth in Latin America.

Micro and macro drivers of corporate investment

It is thus all the more important to understand the dynamics of corporate investment—which accounts for the bulk of overall private investment—and why it has slowed so markedly in recent years. To answer these questions, we study firm-level data for a large data set spanning 24 years and 38 countries, with a total of close to 500,000 company-year observations. We relate the individual firm’s investment-to-capital ratio to a number of firm-specific variables that other studies have focused on—these include expected profitability, cash flows, leverage, and net borrowing.

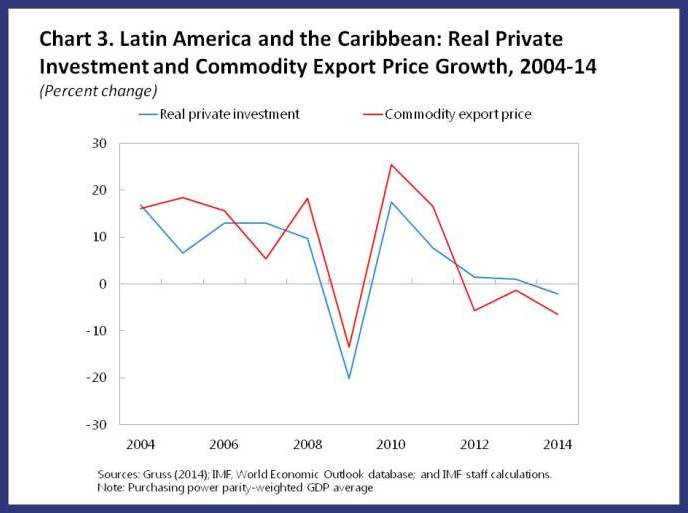

As an innovation, we add several macro-level variables to the model that strike us as particularly relevant for emerging markets. Specifically, we focus on the role of commodity export prices and capital inflows, which have moved in sync with aggregate private investment growth in Latin America over the past decade. Presumably, the ampler the supply of international capital, the less firm investment will be constrained by finance. Meanwhile, higher commodity export prices could stimulate investment—both directly, for commodity-related firms, and indirectly, as economies as a whole receive a positive income windfall (see Chart 3).

Our results show that both the micro-level and macro-level variables are important for understanding corporate investment. Regarding the former, firms that are expected to be more profitable tend to invest more. We also find that firms are financially constrained (in the sense that they rely on internal cash flow to finance their investment) and those with higher existing debt burdens tend to invest less.

Turning to the effects of macroeconomic variables, commodity export prices stand out as a key factor affecting corporate investment. The more commodity export prices rise, the larger the additional investment of the average firm. In Latin America, a one standard deviation shock to commodity export prices (a change of over 10 percentage points) tends to increase the average firm’s investment-capital ratio by nearly 4 percentage points. Importantly, this result holds across all sectors in our data set, and not just in the narrowly defined commodity sector. We also find that times of larger capital inflows coincide with higher corporate investment. Indeed, capital inflows help to relax firms’ financial constraints, particularly for firms that produce nontradable goods.

Understanding the recent slowdown

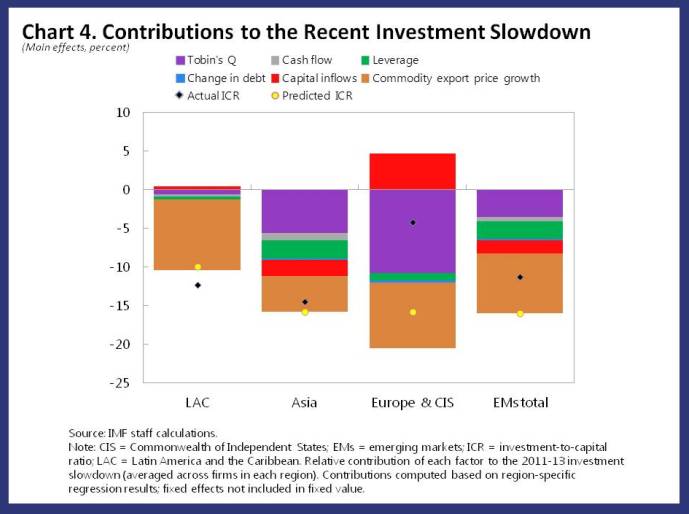

Can these general results also shed light on what has happened since mid-2011? The answer is a clear yes. Although the recent slowdown marks a significant change in investment dynamics, we find that it can still be well explained by the variables in our regression, implying that the relationship between investment and the drivers we examine has not changed in recent years. Rather, some of those drivers have moved sharply since 2011, causing correspondingly sharp moves in investment ratios (see Chart 4).

For Latin America, in particular, lower commodity export prices account for almost the entire decline in average investment-to-capital ratios. In other regions, commodity prices have also played a role, but other factors have contributed significantly, too—including capital inflows, expected profitability, leverage, and financial constraints.

Reviving private investment

With commodity prices generally expected to remain subdued, the outlook for the period ahead is discouraging. Capital flows to emerging markets could also moderate, particularly as U.S. monetary policy starts to normalize. In addition, potential output projections for emerging economies have been revised downward further, thus reducing firms’ expected profitability.

While this implies little boost to investment from cyclical factors, there is nonetheless scope for supportive policy action. For Latin America, some of the long-standing obstacles to higher investment arguably include low domestic saving rates, weak educational outcomes, and challenging business environments in many countries. Tackling these weaknesses is the best strategy for policymakers to revive private investment dynamics and boost medium-term growth prospects, even more so in a less benign external environment.